When analyzing business performance data, leaders often face a critical question: Is this variation normal, or does it signal a real problem? A sales dip could be due to seasonal noise or the beginning of a decline. A spike in customer complaints might be random or indicate a systemic issue. Data accuracy in forecasting relies on understanding normal variations versus actual deviations. Understanding the Bell Curve helps distinguish between signal and noise and improves decisions when outcomes are uncertain.

The Bell Curve graph is a powerful way to render a symmetrical depiction of a probability distribution. It uses statistical analysis to calculate the likelihood of specific outcomes based on observed data.

Understanding Normal Distribution

Consider measuring IQ scores across a large population. Testing everyone on earth would be impossible, but because intelligence levels are evenly distributed across populations, we would expect IQ scores to be normally, or symmetrically, distributed.

Researchers can test a representative sample and use those results to predict the distribution of IQ scores across the entire population with reasonable accuracy.

This is the power of understanding normal distribution. To visualize how this works, we use a Bell Curve.

What is a Bell Curve

Statisticians represent this kind of normal variation with a Bell Curve, so named because its shape resembles a bell, a simple but powerful way to show how outcomes cluster around an average. Its graphical interpretation assumes a predictable spread of outcomes and is the most common type of data distribution.

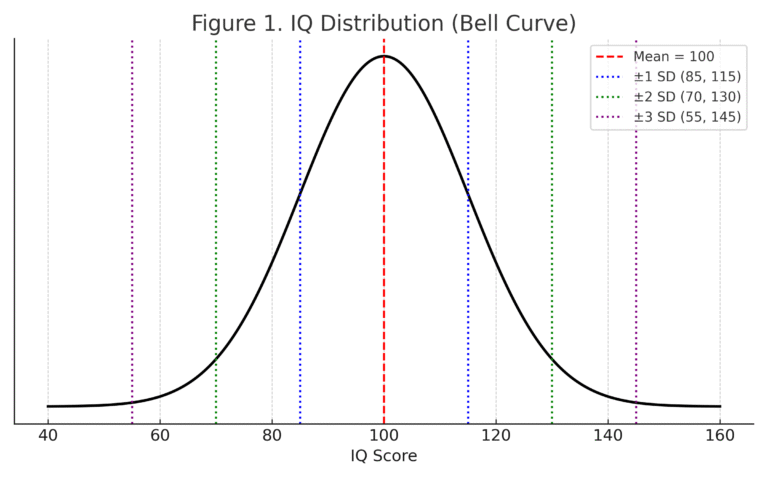

Below is a graph of an IQ Bell Curve.

Figure 1. IQ Distribution

The Bell Curve has two primary metrics: the mean and the standard deviation.

The mean represents the most probable outcome. All other occurrences fall equally on each side, creating downward-sloping lines.

In Figure 1 above, the mean IQ score is 100. Standard deviations measure how far observations deviate from the mean and how dispersed the data is.

Bell Curve Standard Deviations

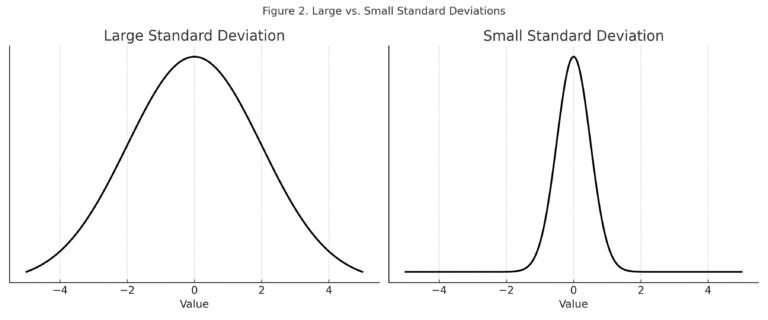

Large deviations indicate wide variability, while small deviations suggest values cluster more tightly.

In Figure 2 below, the left diagram shows a large standard deviation, where values are spread far from the mean. The diagram on the right shows a small standard deviation, where values are concentrated near the mean.

Figure 2. Standard Deviations.

From a probabilistic point of view, standard deviations also measure how rare or likely an observation is. In our IQ example, the mean score is 100, and each standard deviation represents 15 points. Most people fall close to the average, while scores above 130 or below 70 are uncommon. The same pattern shows up in business data. For example, in sales performance, most representatives cluster near the average quota attainment. A sales representative three standard deviations above the mean is not just slightly better, but a clear outlier.

Moving one standard deviation from the mean (85–115) includes about 68% of the population. Two deviations (70–130) cover roughly 96%. Three deviations (55–145) include about 99.7%, meaning almost all possible results fall within this range.

The farther you move from the mean, the fewer observations exist. For example, an IQ of 160 is 60 points above the mean. Dividing by 15 points per standard deviation shows this result is four standard deviations away, a highly unusual outcome.

Bell Curve Percentages

The percentages tied to each standard deviation show how much of the population falls within that range:

One standard deviation from the mean (85–115) includes about 68.2% of the population. Most people fall within this range.

The second standard deviation (70–130) adds another 27.2%, bringing the total to about 95.4% of the population.

The third standard deviation (55–145) accounts for only 4.3%, bringing the total to approximately 99.7% of the population. Almost all. This illustrates how uncommon values are at the outer edges and also how extremely rare results are outside this range.

If we know the standard deviation and the value of the observation, we can work backward to determine how many deviations the observation is from the mean and deduce its likelihood.

Applications

IQ scores are just an illustrative example. The same framework applies in finance, operations, quality control, and forecasting. Leaders use Bell Curves to assess whether changes in sales, costs, or performance are part of normal variability or an indicator of risk and opportunity.

While some phenomena follow asymmetrical or skewed distributions, normal distributions apply to most business metrics and allow leaders to distinguish meaningful signals from random variation in their business data.

Understanding the mean and standard deviation enables you to assess the likelihood of events, determine whether you are observing ordinary fluctuations or a signal that warrants action, and make more informed decisions.